Tax saving india 2013

Savings on taxes is a very important aspect of financial planning. Tax planning is a continuous process and one has to do it every year as their own income changes and due to government regulations as well. An individual must understand few income tax basics which will help them ascertaining income tax liability and further in tax saving as well.

An income tax slabs are different for males, females and senior citizen who are income tax assesses. Below are current tax slabs whose information is very necessary for an individual as it determine the category of tax rate you fall under and rate of tax which will be charged on your taxable income.

Income tax exemptions refer to those incomes which are not taxable at the time of calculating income tax. An individual irrespective of the gender has exemption limit of up to RS two lacs i.

A senior citizen has more exemptions as compared to people under the age of Senior citizen in India gets exemption limit of RS five lacs and till this figure, they are not liable to pay any income tax to the government.

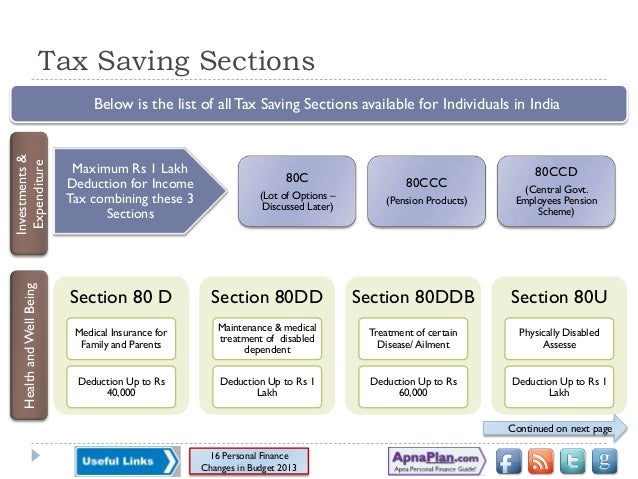

Deduction is the amount, which is reduced from the gross total income before computing tax. There are various sections of income tax under which certain deductions are allowed to an individual as described below:. Tax saving schemes is a great way to lessen the Tax burden of people, especially of middle class who undergo the heat of paying heavy taxes and intensified tax structure.

Hence, the earner needs to be calculative enough to save his tax in many ways by following some simple steps mentioned below:.

Income tax in India - Wikipedia

Home Life Insurance Investment Plans Articles - IP Income Tax Guide. Income tax Slab An income tax slabs are different for males, females and senior citizen who are income tax assesses. Income Bracket Rate 0 to Rs. Income Tax Deductions Deduction is the amount, which is reduced from the gross total income before computing tax. There are various sections of income tax under which certain deductions are allowed to an individual as described below: The total deduction under this section along with section 80CCC and 80CCD is limited to Rs.

Life Insurance Premium For individual, policy must be in self or spouse's or any child's name.

Comprehensive List of All Tax Free and Tax Saving Investments in India for

Sum paid under contract for deferred annuity for individual, on life of self, spouse or any child. Contribution to Unit Linked Insurance Plan of LIC Mutual Fund. Payment of premium for annuity plan of LIC or any other insurer Deduction is available up to a maximum of RS.

An additional deduction up to a maximum of Rs. Deduction is available up to Rs.

Additionally, a deduction for insurance of parents father or mother or both is available to the extent of Rs. This section provides for deduction for disabled people.

Further, if the defendant is a person with severe disability a deduction of Rs.

How to Calculate Income Tax in India 2013 - Part 1This section provides for deduction in respect of medical expenditure on self or dependent relative. A deduction to the extent of Rs.

In case of senior citizens, this limit is RS This section provides for deduction in respect of interest on loan for higher studies. Deduction is allowed for repayment of interest component of Higher Education loan. Tax Saving Schemes Tax saving schemes is a great way to lessen the Tax burden of people, especially of middle class who undergo the heat of paying heavy taxes and intensified tax structure. Hence, the earner needs to be calculative enough to save his tax in many ways by following some simple steps mentioned below: The provision under Section 80C of the Income Tax Act permits specific investments and expenses to be tax free.

All these investment can be made from any source.

Tax Saving Schemes in India – With all Saving Sections

Collapse fncGetFormInPage 'investment','1',0 ;. Displayed next to your comments.

Comments will undergo moderation before they get published. Related plans LIC Traditional Plans Tata AIA Traditional Plans Reliance Life Traditional Plans SBI Life Traditional Plans Kotak Life Traditional Plans PNB MetLife Traditional Plans DHFL Pramerica Traditional Plans IndiaFirst Traditional Plans Edelweiss Tokio Life Traditional Plans Star Union Traditional Plans.

Get Article On Email. Policybazaar does not in any form or manner endorse the information so provided on the website and strives to provide factual and unbiased information to customers to assist in making informed insurance choices.

UHRPTC Policybazaar Insurance Web Aggregator Private Limited, Registered Office no. Visitors are hereby informed that their information submitted on the website may be shared with insurers. Add More Members Father Mother Father-In-Law Mother-In-Law Grand Father Grand Mother.