Best dividend stocks for 2016 canada

The list of dividend stocks remain the same but with updated numbers. Dividend investing is a popular strategy these days, especially with low interest rates and not a lot of other options to obtain income from your hard earned savings. For those of you interested in this strategy as well, you can see an example through my leveraged dividend portfolio. In fact, growing a passive dividend income stream is my strategy for achieving financial freedom.

As a dividend growth investor, I like to invest in dividend paying companies that have a history of increasing their dividends. Unfortunately, the TSX has a limited number of stocks that have a long dividend growth history. I basically cut the list off of companies that have paid increasing dividends for at least 15 years.

I have created a list below, but more due diligence is required before you buy as the only criteria I used is number of years of increasing dividends. My holdings include CU,FTS, CWB, TRI, ESI, IMO, ENB, CNQ, SNC, EMP. For me, I like dividend stocks with a yield above 2. Once I create a dividend stock watchlistI wait for them to drop in price to reach a particular dividend yield when to buy dividend stocks.

Canada’s Top 10 Best Growth Stocks for

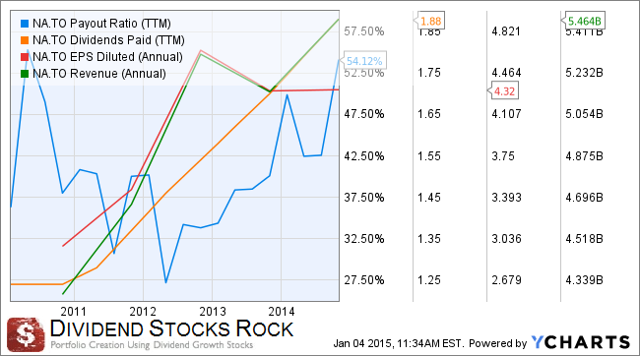

For example, from the table above, there are some stocks with red flags such as the oil companies with negative earnings high payout ratio. If you are looking to build a portfolio of dividend growth stocks, some other considerations include market capitalization ie. In a future article, I will put together my thoughts on an ideal diversified dividend growth portfolio. FT is the founder and editor of Million Dollar Journey est. You can read more about him here.

This gives me a few ideas investigate further. There are a couple of good names here too though, like Empire, Ensign and Canadian REIT. Hi Frugal — what earnings numbers do you use to calculate payout ratio? The main reason I ask is that my spreadsheet link below has TCL posting losses, and a negative payout ratio currently. With regards to your leveraged portfolio and performing the Smith manoeuvre, it is my understanding that one must have an expectation of income in your case, dividends in order to make the interest on their investment loan tax deductible.

Sales of securities under an investment loan still qualify for capital gains tax ie. I would definitely avoid AGF and TCL. All 5 big banks, all telcos, all life insurance and many energy and utilities. Can one really declare the borrowed money is for the purpose of income generation, receive tax deductions on the interest and yet still call the purchased securities capital property? You are mixing apples and oranges.

Owning stocks is owning a share of a business expected to earn income filtered to you directly div or indirectly value appreciation which meets purpose. That is not the case for FT. He is a sporadic and passive investor.

Canadian dividend stocks portfolio

What FT is doing, tens of thousands are as well. His case is rather clear cut and uncontroversial… which is not always so. As someone trying to educate himself on the exact mechanics of the Smith manoeuvre and how it fits into our tax system I still find it strange that one can declare the purpose of an investment loan to be income generating but can call the purchased securities capital property rather than income property.

I would take these things into account when making decisions but a good article. Its the same thing with every other investments, never mind Smith Manoeuvre. For example, in a regular account, if you buy income trust that channel all its earnings to shareholders through dividends, you are buying a capital asset for the purpose of income. But when you sell your income trust, its a capital gains.

Smith Manoeuvre or not, buying shares is buying a business for the purpose of income.

And when selling said shares, its a capital gains for sporadic, passive investors like FT. Phases of a Bull Market: And then there is the problem with ego. John Our tax system is a mess. The Smith manoeuvre is obviously an income tax avoidance mechanism loophole and the fact that CRA is not currently doing best dividend stocks for 2016 canada about it is mind-blowing. People borrow to invest all the time leverageeither through equities, their business, or rental properties.

How do free indicators for binary options obuchenie see the SM as a tax loophole? I was happy to see that my list of 20 US stocks and 10 Cdn stocks both beat dividend ETFs and global index this year after 3 months. You get the deductibility for your investment loan since you are taking a risk. How large or small of a risk is not the point. And its a loan. In the US, mortgage interest loans are deductible, no need for SMs.

SM in Canada allows for a middle ground between the US way, and not at all. Any thoughts on Royal Gold? It looks like I might have to add it to the Canadian Dividend All-Star List as it has more than 5 years of dividend increases. Great list as it has a mix of stocks from across a diversified spectrum of industries; however I invest in U. Look forward to your post on top U. S dividend growth stocks. Special binary options strategy pdf streaks may be short due to freezes brought on by the great recession but how can anyone discount TD, BNS or CM who never once cut their dividend or RY and BMO who last cut over 70 years ago?

Peter, try this Canadian PF website: I disagree with Metro and Saputo in your list. The yield is too low. I prefer the sweet spot which is 3 to 4. I also like to purchase just enough shares to have the DRIP buy 1 share and then that is dripped next dividend payment.

Of course, you buy a few more shares just in case it goes up. When the yield is too low, you end up paying way too much to get a DRIP share. I prefer to get shares and this way, I am truly in it for the long run.

A lot of people say they are in it for the long run. This 1 DRIP share gives me something to look forward to. The next dividend payment will be even bigger. What do you think of Brookfield Asset Management TSX: I am considering buying. Love the Canadian Dividend All-Stars and try to keep my portfolio picks jupiter stock broker that realm.

Tons of great names here. I own several of the big Canadian banks, and while their yield is higher, their value in my portfolio is average. Clearly, there is more to dividend investing than yield alone. I was wondering what your thoughts were on The equitable Life Insurance Company of Canada.

Is this a good idea? No, that would be very, very bad advice. Run away from whoever told you that because those products are some of the most notoriously bad financial products with many excessive and hidden fees attached. Some very high quality picks in that list!

Look at all those boring names. I like SAP, HCG, CNR, MRU and CWB from there. I think SAP is a bit expensive. CNR and MRU are fair HCG and CWB are great value now. Why does this list not include Brookfield infrastructure BIP.

UN or Brookfield Renewable BEP. Seems like a huge omission. I would take either of these over most of the companies in the list. Good point Jimmy, BIP. UN is a very popular stock among dividend investors. My records are showing that they have increased their dividends for 8 years in a row. But you are right, I would not build a dividend portfolio solely on this list.

Thanks for the list and a fantastic chat going on here. I agree brookfield renewable should be on here. Notify me of followup comments via e-mail.

Should I buy Whole Life Insurance for my Children? Top 16 Canadian Dividend Growth Stocks for by FT on October 31, Dividend Growth Stocks for The Largest Oil and Gas Dividend Stocks Knowing When to Buy Dividend Stocks The Best Canadian Dividend ETFs The Dogs of the TSX Echo April 8, AGF scares me a bit with its nearly double-digit yield. Canadian Dividend Blogger April 8, Jordan April 8, John April 8,6: FrugalTrader April 8,7: My Own Advisor April 8, I hold a few position above.

Top 5 dividend stocks of canadaMany banks fall into that list. Unfortunately, few others in Canada do. I see very few deals in the CDN market right now. I think you have more holdings than I do: John April 8, Goldberg April 9, John April 9,1: Goldberg, thanks for your response. Roni Mitra April 9,2: FrugalTrader April 9,7: Goldberg April 10,9: SST April 10,9: CanadianTaxSystemIsAJoke April 10,9: FrugalTrader April 11,9: The Dividend Guy April 11,9: I should have bought all those stocks ;- lol!

Goldberg April 11, Michael June 15, SST June 16,2: Victor July 31,4: Bernie November 9,1: Peter November 13,2: Did you mention the dividend astrocrats list for Canada?

Provides a good starting list for companies that always increase dividends…. Peter November 15, SST November 15, Chris Daniels November 18, Peter November 19,2: Yves Quevillon November 29, Dividend Beginner May 8,8: Patrick June 13,6: Arlene October 31, Stephen November 4,1: BeSmartRich November 5,8: But if you are holding them for a decade or so, then it does not really matter.

FrugalTrader November 28,4: Passivecanadianincome February 6, Eric February 7,6: What do you think of the following ETFs or stocks as another source of dividend generator? How to … Have a Tax Deductible Mortgage Choose the Best Bank Mutual Funds Buy and Sell Stocks Retire Really Early Save a Lot of Money Start a Blog on a Budget.

A Simple Index Investing Guide for Americans 7 Smart Ways to Spend your Tax Refund Monday Money Links — Dividend Advisor Promo, Home Capital Group, Advice for New Graduates — May The Ten Roads to Riches Bumped from a Flight?