Forex audit of banks

It seems that every country's central bank these days is involved in some sort of capital control over their currency. Set aside from standard monetary and fiscal strategies, these policies are used to keep domestic denominations under control while keeping a country's growth stable.

One of the most frequented strategies used by policy makers is direct market intervention. Japan's central bank has used the strategy on more than one occasion. By printing Japanese yen to sell, and buying back U.

To learn more, see The U. Dollar And The Yen: But that's not the only method that is being used, and the Bank of Japan is certainly not the only one intervening in the FX market. So let's take a look at some other capital control strategies that are being used by global central banks and how to take advantage of such an opportunity. Korea's Intervention South Korea, with an export economy similar to Japan's, is a country that has also been known to intervene in the foreign exchange markets directly in order to control the rise and fall of its currency, the South Korean won KRW.

But things have changed, and South Korea's central bank is looking for additional means of control.

Tighter Audit For Forex-Dealing Branches | Business Standard News

An alternative to applying direct intervention in the markets, government officials and the Bank of Korea are beginning to audit banks and larger institutions handling currency market transactions.

Aimed at curbing speculation, the regulations tighten requirements on the country's banks trading in large currency derivativespotentially punishing those that are unprofessionally or improperly transacting in the market. Aiding in the reduction of currency speculation, the strategy increases government scrutiny over market positioning and would support higher requirements on currency positions for foreign currency speculators.

All in all, the measure looks to gradually reduce interest in the South Korean won as it becomes more costly to trade currency in the country. Another way to curb interest and speculation in a country's currency is through higher foreign investment taxes.

Brazil's Tax Change The Brazilian government implemented measures in order to curb its own currency's speculation — aside from directly selling Brazilian reals and buying U. One such measure is to increase the foreign tax rate on fixed income or bond investments.

Increasing the country's foreign tax rate is going to make transacting in Brazil more costly for speculators in banks and larger financial institutions abroad — supporting a disinterest in the Brazilian currency and decreasing the amount of "hot money" flowing into the Brazilian economy.

To learn more, see The New World Of Emerging Market Currencies. Using Central Bank Interventions to Your Advantage Global central banks sometimes refer to strategies and tools that are already at their disposal.

We all know that market speculation accelerates when central banks raise interest rates. During these times, investors look to capture any yield difference between their own currencies and higher yielding currencies. But, in times of massive market speculation, central banks may be forced to actually cut interest rates — hoping to deter any speculation on higher interest rates.

Central banks lowering interest rates are hoping to narrow the yield differential with other economies — making it less attractive for currency speculators attempting to take advantage of a wider yield difference. But, how can one take advantage of these opportunities? Although central banks apply capital controls on their domestic currencies, these policies tend to do little damage to the overall trend. In the short term, the announcement will temporarily shock markets. But, in the long run, the market ultimately reverts back to its original path.

Learn more in Interest Rates Matter For Forex Traders. An Example of How to Profit Announcements of intervention offer great opportunities to initiate positions in the same direction as the recent trend.

Let's take a look at the direct intervention efforts of the Bank of Japan on September 15, It was during this time that traders bought Japanese yen and sold U. Pengalaman trading forex di fbs momentum helped the Japanese yen appreciate against the U. As a result of the yen's quick appreciation, the Bank forex audit of banks Japan decided to intervene for the first time in six years.

The stronger yen was making Japanese products uncompetitive overseas. In Figure 2, we can see the effects of intervention on our daily chart. Now, this is where it gets interesting.

The intervention efforts by the Bank of Japan drove the currency to test projected resistance red line dating back to the currency's short-term top in May. Zooming in Figure 3we can see that the next two days produced strategy for a novice binary options 60 sec dojis just below support at Dojis signify that momentum in the market following the intervention is foreign currency exchange islamabad — a sign of resistance failure.

Attempting to enter into the current bearish trend, we place a short entry at This is just enough to confirm a breakdown in the short-term price action while remaining just below the A corresponding stop is placed about pips above our entry price - just enough to keep us in the position.

Bottom Line With increased speculation in the market, central banks will continue to apply capital controls in order to control their currency's exchange rates. These present great opportunities for start earning passive income investors and traders to seize entries into longer-term trends — as intervention scenarios rarely work for the policy makers.

For a step-by-step guide to trading forex, check out our Forex Walkthrough. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

Latest Videos PeerStreet Offers New Way to Bet on Housing How to trade daily alert candles in forex to Buying Bitcoin?

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Taking Advantage Of Central Bank Interventions By Richard Lee Share. The Forex Market But that's not the only method that is being used, and the Bank of Japan is certainly not the only one intervening in the FX market. Figure 1 As a result of the yen's quick appreciation, the Bank of Japan decided to intervene for the first time in six years.

Figure 2 Now, this is where it gets interesting. Figure 3 Attempting to enter into the current bearish trend, we place a short entry at Figure 4 Bottom Line With increased speculation in the market, central banks will continue to apply capital controls in order to control their currency's exchange rates.

The forex market can be extremely profitable. Learn how to spot an intervention and trade when it's occurring. Although it has fallen to number four on the trading partner list, Japan and its currency have a large impact on the American economy. Currency fluctuations often defy logic. Learn the trends and factors that result in these movements.

Interest Rates for RFC Deposits- Federal Bank - Federal Bank

Central banks use these strategies to calm inflation, but they can also provide longer-term clues for forex traders. The Japanese Yen possesses some unique qualities that traders should know before jumping in.

Currency fluctuations are a natural outcome of the floating exchange rate system that is the norm for most major economies. The exchange rate of one currency versus the other is influenced by Unique features of the forex market may allow larger players to get a jump on smaller ones. Currencies can provide diversification for a portfolio that's in a rut. Find out which ones you need to know. We go over some of the things you need to understand before you can trade currencies.

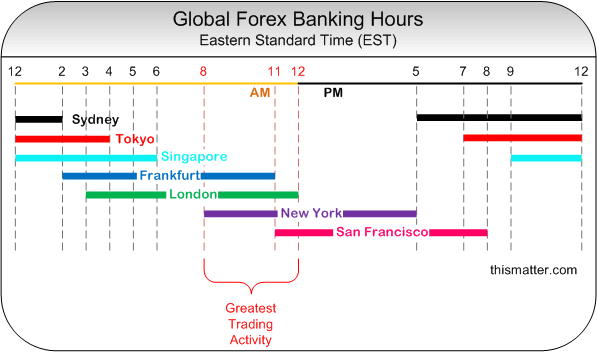

Exchange rates float freely against one another, which means they are in constant fluctuation. Currency valuations are determined How someone makes money in forex is a speculative risk: In the forex market, currencies from all over the world can be traded at all times of the day.

The forex market is very liquid, Read about the causes of currency devaluation, and find out how to differentiate between relative and absolute currency devaluation. An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other.

A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Frank Denneman

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.