Stocks and the stock market explained for young investors

One of the best things about being a young investor is that the "magic of compound interest" is actually applicable. Young traders have more time to grow their accounts, are less damaged by short-term drawdowns, and - for the most part - show more willingness to try new types of trading strategies.

T I stated explicitly my belief on stocks versus options: The only reason to buy stocks is dividends. I'm not going to make this article an argument on options versus stocks. I just want to properly set the stage by pointing out the importance of dividends; in dividends, we see the only important advantage of holding stocks for the long-term over options. You can read or watch my other materials on options to understand why I feel this way.

In short, proper options strategies can mimic stocks in a superior way - e. After discovering options, I never imagined going back to stock investments. However, dividends brought me back. Dividend stock is the best place to park your cash when you don't want to worry about daily fluctuations yet don't want to keep the cash in its original, non-profitable form. For those who are unfamiliar with my trading career, I started out with buying growth stock and funds but found the gains too low in raw terms.

After building a successful trading career through unconventional gap trading with options, I have not forgotten my beginnings - the struggles of a young investor. Experience is education, and one thing I learned about investing is that trading for growth options should be matched with investing for savings dividend stocks.

Buying options is playing blackjack with card-counting skills; buying dividend stocks is being the casino. I recommend young investors play the role of a casino owner who has the day job of a blackjack player. You will notice that most of my articles on Seeking Alpha are blackjack strategies, but today I'm going to give you some of my ideas on purchasing a casino. This is in response to the many, many requests I have received for my top dividend picks for These requests are related to my most viewed YouTube video, the 5 Best Dividend Stocks of You are welcome to skip directly to the picks below.

However, younger investors might be interested in the story that drove me, a high-risk trader, to dividend stocks. Please read my story below if you are young, as you will likely go through roughly the same transition as I. My years in graduate school taught me more than just psychology my major - it also taught me money management.

I worked hard as a Chinese-to-English translator for low earnings but was able to sustain myself through frugal living. Being a guy who prided himself on making scientifically accurate decisions, I put my savings into random stocks - literally: The stocks in my small portfolio were chosen at random. That's the scientifically accurate decision - after all, the studies showed that children and monkeys were superior at choosing high-performance stocks when compared to fund managers and analysts.

My random choices were in line with the scientific data and greatly reduced the time expense needed for stock selection. You are probably thinking that this is the point in the story where I learn that choosing stock at random is silly and I suddenly saw the light of listening to the experts instead.

4 Types of Stock Market Investment Strategies - Investing, Speculation, Trading & Bogeling

In fact, the portfolio outperformed the market. The problem was that I was not seeing the gains I was promised. I was determined to find a faster way. My solution, which I won't detail here, was built on designing high-ROI trades and altering the risk-reward profile of the trade via options.

In short, I used my background in statistics to design a card-counting strategy for blackjack. The rest is history, but one important lesson that I learned through the process and rarely mention because it is not so glamorous or exciting to my subscribers, followers, and students is proper money management.

This includes both position sizing and "storage. These days, I am always looking for good dividend stocks to park my money. And I highly recommend you do the same as you begin your investment career. Kronos Worldwide offers a 3. The diversification geographically should hold for the long term, as KRO has few competitors that could possibly steal significant chunks of market share in a given area.

My backtests on the stock show it to be one of logical reactions to market-specific and company-specific news; thus, we can conclude that not much of the price movements for this stock are based on hype or sentiment.

So we have a dividend stock that is easy to analyze: We look at the fundamentals instead of the news. And many of the fundamental aspects of this company look strong. For example, KRO has recovered from negative growth and has remained in positive territory for the past four years, showing a slow but steady upward trend:. Analysts estimate strong profit growth over the coming years, and we are already seeing cash flow rising:. The company is supported by a growing macro market, giving us growth on a company that is already paying a decent, safe dividend:.

I think KRO is a great investment regardless of your risk tolerance. It is an underfollowed company in a market that is rather easy to understand, allowing investors to keep track of this investment without much work. The international exposure is passed onto you, giving you fund-like diversification in a stock.

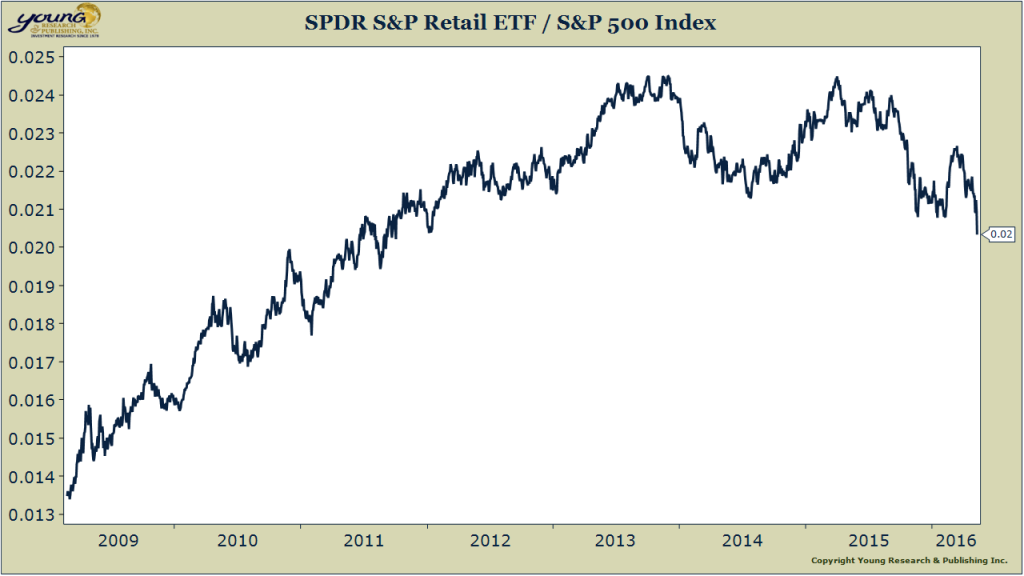

Target was a stable investment until recently, yet the growing dividend - currently at 4. The changing macro environment is squeezing out the middle class Target's target and punishing brick-and-mortar stocks in favor of online companies. For this reason, Target is the target I will never get bored of such phrases of negative sentiment and shorts. If you are - like me - interested in a contrarian dividend stock because you think the market is overreacting, because you realize that brick-and-mortar's previous commodities are becoming luxuries e.

The technical side of things indeed show now to be a good entry point: Most of Target's down gaps are overreactions and result in smiley-face rebounds:. Historically, these gaps fill. This means that Target investors see selloffs as targets for discount-buying.

I believe that once the Amazon NASDAQ: AMZN scare dies down, Target will see its upward momentum return, once again becoming the target of dividend investors. For now, it's at a nice discount for anyone who doesn't mind waiting for that moment. I wouldn't blame you for buying now. The insiders certainly don't mind waiting:. Cross Timbers Royalty Trust NYSE: For young dividend investors who feel that quarterly payments, CRT offers monthly dividends that add up to a 6.

This is a natural gas play, which is often confused with oil plays. These are different commodities, and natural gas looks - at least to me - to have better future prospects, with consumption peaking in Dividend per share is not stable, but that's expected for a company that gives yields close to double digits.

Because this is a company that derives most of its income directly from natural gas, expect the company's stock and dividends to be at the mercy of natural gas price fluctuations.

This is not a dividend investment for the faint of heart, but it can be highly profitable if you're willing to accept the risk.

Stock Market Basics For Young Investors

I don't recommend buying this stock unless you have a bullish thesis on the natural gas industry as a whole. But if you do hold such a thesis, CRT is a great choice.

It has a price-to-earnings PE of If you are looking for safety and diversification, CRT is not for you. If you want aggressive exposure to natural gas while reaping the most enjoyable part of dividend investments i. Pebblebrook Hotel Trust NYSE: PEB is a macro play for the Trump administration and offers a yield of 4. While the macro environment for hotels and real estate hasn't been exactly great to-date, I believe that things are about to change. Not only do we have a president who made his fortunes from real estate - much of it being hotels - but we also have a strong US dollar.

The former lends evidence to the idea that regulations on the hotel and real estate industries will be more likely to become more lenient than more strict. It also implies that lobbying on the part of the hotel industry and real estate industry is likely to find more success; the leader of the nation's economy has a soft spot and connections to this industry. This is an oft-ignored tailwind that could potentially last eight years.

The latter is important because it drives investment domestically. It is hard to invest in a foreign company or a company with much foreign exposure when you know that profits will be hit hard by forex conversions. Republican administrations are correlated to stronger currency in the US, and we should consider this factor when looking for reliable dividend payers.

PEB in particular is attractive as a dividend stock because of its reliable dividend. Even during hard times, the company a real estate investment trust raises its dividend. The end-buyer concerns of dividend cuts and debt risk that usually come with a young dividend stock like PEB is countered by its seasoned management. I think you can count on more dividend growth moving forward, making PEB a strong choice for a young portfolio at the beginning of what might be a real estate comeback.

WETF is a hugely profitable dividend player that currently pays investors an annual yield of 3. The surge in profits we have with this stock comes with zero debt:. What could WETF be selling? The answer is hidden in the ticker: This is the only stock that gives you access to the money spent on ETFs. This has been a great investment in light of the transition away from mutual funds and into the better-performing and lower-cost ETFs.

The transition has momentum, and ETFs are now the default investment of someone who wants exposure to an industry but doesn't want to commit to building a portfolio of stocks for that industry. With the macro factor on our side, WETF offers growth in addition to a significant yield. Arguably, the company was overhyped and now more fairly valued.

Business News, Personal Finance and Money News - ABC News

As a dividend investor, I am not opposed to a sideways-trending stock if it offers a good yield, which is true of WETF. But more important here are the metrics that imply growth: WETF shows a return on assets of These metrics are typically not double digits in this industry, and on that note, WETF seems underappreciated.

Again, it is the only reasonable vehicle of exposure to ETF sales, so I think this is a unique dividend choice - a highly profitable business, listed on an exchange with no legitimate peers, and trading at a relative bottom; this is my top pick for a dividend play in the financial sector.

I hope this article has helped you in your search for a profitable place to set your cash. If you're not following me, please click on the "follow" button above for more articles like this one.

Make sure you choose "real-time alerts. I built my trading career on gap trading. See this quick guide for 11 ways to trade gaps. All unlabeled figures were created by me. I used R to pull data directly from Yahoo and ADVN. Charts with blue backgrounds are from Etrade Pro.

Fundamental charts from a paid subscription at simplywall. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it other than from Seeking Alpha. I have no business relationship with any company whose stock is mentioned in this article.

REITs Dividend Ideas Dividend Strategy Dividend News Dividend Quick Picks Editor's Picks.

Top 5 Dividend Stocks For Young Investors May 25, 5: Summary Dividend stocks are my preferred means of money management between trades. Young investors can learn from my story. I give my top five dividend stock picks for Want to share your opinion on this article? Disagree with this article? To report a factual error in this article, click here. Follow Damon Verial and get email alerts.