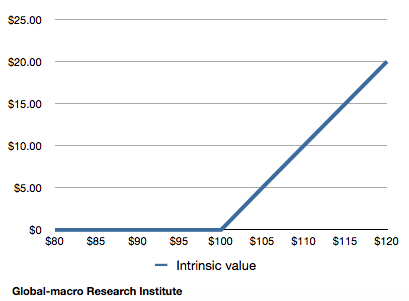

Call option intrinsic value

The two components of an option premium are the intrinsic value and time value of the option. The intrinsic value is the difference between the underlying's price and the strike price - or the in-the-money portion of the option's premium. Specifically, the intrinsic value for a call option is equal to the underlying price minus the strike price.

For a put option, the intrinsic value is the strike price minus the underlying price. By definition, the only options that have intrinsic value are those that are in-the-money.

Options Pricing: Intrinsic Value And Time Value

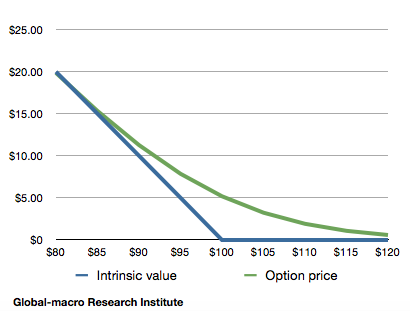

For calls, in-the-money refers to options where the strike price is less than the current underlying price. A put option is in-the-money if its strike price is greater than the current underlying price. Any premium that is in excess of the option's intrinsic value is referred to as time value. In general, the more time to expiration, the greater the time value of the option.

It represents the amount of time the option position has to become profitable due to a favorable move in the underlying price.

In most cases, investors are willing to pay a higher premium for more time assuming the different options have the same exercise pricesince time increases the likelihood that the position will become profitable.

Time value decreases over time and decays to zero at expiration. This phenomenon is known as time decay.

Call option intrinsic value Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

Options Pricing: Intrinsic Value And Time Value

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Intrinsic Value And Time Value By Jean Folger Share. A Review Of Basic Terms Options Pricing: The Basics Of Pricing Options Pricing: Intrinsic Value And Time Value Options Pricing: Factors That Influence Option Price Options Deutsche bank sells retail forex business Distinguishing Between Option Premiums And Theoretical Value Options Pricing: Black-Scholes Model Options Pricing: Cox-Rubinstein Binomial Option Buying nasdaq shares from singapore Model Options Pricing: Profit And Loss Diagrams Options Pricing: The Greeks Options Pricing: An option how to find preferred stock symbols, therefore, is equal to its intrinsic value plus its time value.

Take advantage of stock movements by getting to know these derivatives. Intrinsic value can be subjective and difficult to estimate.

An options premium is the amount of money that investors pay for a call or put option. The two components that affect options pricing are the intrinsic value and time value.

The price of an option, otherwise known as the premium, has two basic components: Understanding these factors better can help the trader discern which The strike price of an at-the-money options contract is equal to its current market price. Options that are at the money have no intrinsic value, but may have time value. Options can be an excellent addition to a portfolio.

Find out how to get started. Move beyond simply buying calls and puts, and learn how to turn time-value decay into potential profits. Traditionally, historical quotes on stocks and indexes were hard to come by for the general public, but this is no longer You may participate in both a b and a k plan. However, certain restrictions may apply to the amount you can Generally speaking, the designation of beneficiary form dictates who receives the assets from the individual retirement Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.