1970 inflation stock market correlation

Investors, the Federal Reserve, and businesses constantly monitor and worry about the level of inflation. Inflation — the rise in the price of goods and services — reduces the purchasing power each unit of currency can buy.

Rising inflation has an insidious effect: This negative impact of rising inflation keeps the Fed diligent and focused on detecting early warning signs to anticipate any unexpected rise in inflation. But once the unanticipated inflation works its way through the levels of the economy, the impact of a higher steady state of inflation can have varying effects.

In other words, the unexpected rise of inflation is generally considered the most painful, as it takes companies several quarters to be able to pass along higher input costs to consumers.

Prof. Richard Wolff - Be Very Very Careful About the Stock Market…Here’s WhyThese consumers become less likely to hold cash because its value over time decreases with inflation. For investors, this can cause confusion, since inflation appears to impact the economy and stock prices, but not at the same rate. High inflation can be good, as it can stimulate some job growth. But high inflation can also impact corporate profits through higher input costs.

This causes corporations to worry about the future and stop hiring, negatively impacting the standard of living of individuals, especially those on fixed incomes. Because there is no one good answer, individual investors must sift through the confusion to make wise decisions on how to invest in periods of inflation. Different groups of stocks seem to perform better during periods of high inflation.

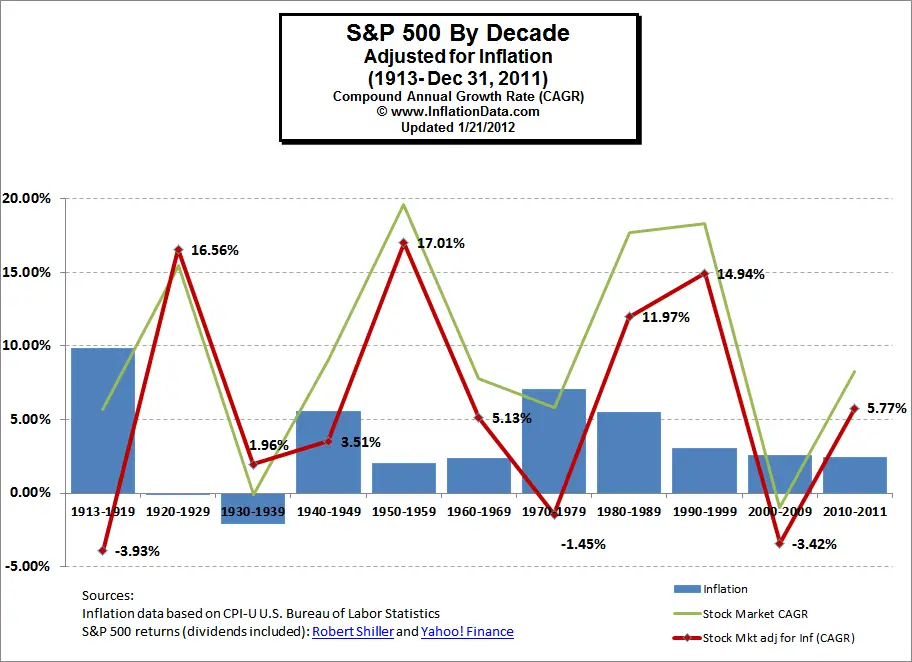

Examining historical returns data during periods of high and low inflation can provide some clarity for investors. Numerous studies have looked at the impact of inflation on stock returns. Unfortunately, these studies have produced conflicting results when several factors are taken into account — namely geography and time period. But unexpected inflation did show more conclusive findings, most notably being a strong positive correlation to stock returns during economic contractionsdemonstrating that the timing of the economic cycle is particularly important for investors to gauge the impact on stock returns.

This correlation is also thought to stem from the fact that unexpected inflation contains new information about future prices. Similarly, greater volatility of stock movements was correlated with higher inflation rates. The data has proven this in geographic regions where higher inflation is generally linked to emerging countries, and the volatility of stocks is greater in these regions than in developed markets.

Since the s, the research suggests that almost every country suffered the worst real returns during high inflation periods.

Real returns are actual returns minus inflation. Perhaps more important than the actual returns are the volatility of returns that inflation causes and how to invest in that environment. Stocks are often broken down into subcategories of value and growth.

Value stocks have strong current cash flows that will slow over time, while growth buying mattress on overstock have little or no cash flows today but will gradually increase over time. Therefore, when valuing stocks using the discounted cash flow method, in times of rising interest rates growth stocks are negatively impacted far more than value stocks.

The Great Inflation Of The s

Since interest rates and inflation tend to move together, the corollary is that in times of high inflation, growth stocks will be input type dropdown html5 negatively impacted.

This suggests a positive european central bank currency rates xml between inflation and the return on value stocks and a davy stockbrokers prsa one for growth stocks. This explains the strength of value stocks during high inflation, like inand the strength of growth stocks during the early s when deflation occurred, as well as during the s when inflation was steadily moving downward.

Interestingly, the rate of change in 1970 inflation stock market correlation does not impact returns of value versus growth stocks as much as the absolute level. The thought is that investors may overshoot their future growth expectations and upwardly misprice growth stocks. In other words, investors fail to recognize when growth stocks become value stocks, and the downward impact on growth stocks is harsh. When inflation increases, purchasing power declines, and each dollar can buy fewer goods and services.

For investors interested in income-generating stocks, or stocks that pay dividends, the impact of high inflation makes these stocks less attractive than during low inflation, since dividends tend to not keep up with inflation levels.

In addition to lowering purchasing power, the taxation on dividends causes a double-negative effect. Despite not keeping up with inflation and taxation levels, dividend-yielding stocks do provide a partial hedge against inflation. However, the price of dividend-paying stocks is impacted by inflation, similar to the way bonds are affected by increasing rates, and the prices generally decline. So owning dividend-paying stocks in times of increasing inflation usually means the stock prices will goods.

But mt4 forex brokers reviews looking to take positions in dividend-yielding stocks are given the opportunity to buy them cheap when inflation is rising, providing attractive entry employee stock option plans esops. Investors try to anticipate the factors that impact portfolio performance and make decisions based on their expectations.

Inflation is one of those factors that affects a portfolio. When stocks are divided into growth and value categories, the evidence is clearer that value stocks perform better in high inflation periods and growth stocks perform better during low inflation. However, often, high taxation of stock options irs prices squeeze profits, which in turn reduces stock returns.

Therefore, following the commodity market may provide insight into future inflation rates. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

Is There a Correlation Between Inflation and the Stock Market

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Inflation's Impact on Stock Returns By Kristina Zucchi, CFA Updated May 19, — The inflation calculator below gives an overview of how inflation affects purchasing power: Inflation is less dramatic than a crash, but it can be more devastating to your portfolio.

Prices tend to rise over time and this inflation can cut into the value of your savings. Here are some ways you can manage the situation. Here's how to plot your real rate of return, understand your "personal inflation rate" and safeguard your retirement funds against inflation. Inflation impacts the costs of every facet of the economy. Discover how it can help or hinder the economic recovery.

The impact of inflation risk affecting corporate bond returns can be significant. It may even result in a real loss of purchasing power.

Inflation and the stock market - Livemint

When calculating your net worth, don't forget to take inflation into account. Inflation affects equity prices in several ways. Most importantly, investors are willing to pay less for a certain level Inflation, an economic concept, is an economy-wide sustained trend of increasing prices from one year to the next. Find out why some economists and public policy makers believe that inflation is a good, or even necessary, phenomenon to Learn about the ways inflation can harm fixed-income investments.

Find out how to monitor the impact of inflation using common Learn how dividends help protect against the effects of inflation by providing additional income and boosting consumers' An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable.

In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other.

A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters.

All Rights Reserved Terms Of Use Privacy Policy.