Best stocks to trade iron condors

Compared to a regular credit spread, the Iron Condor can greatly increase often double! In this white paper we will contrast the Iron Condor credit spread pair with the plain vanilla credit spread. Although credit spreads carry risk as well as reward potential, they are among the most conservative option investment strategies. But too often, even regular users of option credit spreads leave a lot of money on the table because they fail to take full advantage of a specific Iron Condor selection strategy.

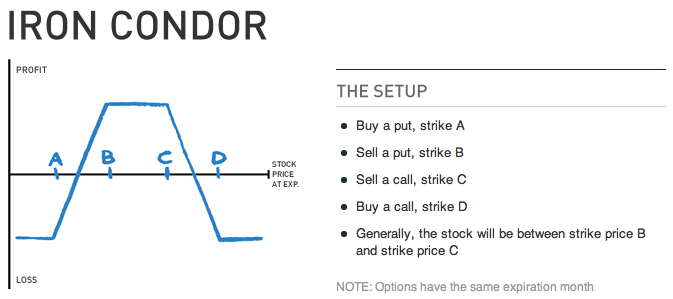

The basic option credit spread is a short option strike price and a long option strike price more distant from the underlying in the same underlying stock, ETF, or Index, with the two options having the same expiration date. It may be a bull Put credit spread or a bear Call credit spread.

The Iron Condor is simply two option credit spreads — one bull Put spread and one bear Call spread — that meet the specific definition of an Iron Condor. Specifically, both credit spreads must: As noted earlier, the Iron Condor pair of credit spreads offers a mega-increase in income potential at no increase in risk if the Iron Condor strategy employed is correct.

Total Margin cash in account required to support credit spread: The Iron Condor trade might look like this:. Total Margin cash in account required to support BOTH spreads: Recall in Example 1 that our desire is for the underlying XYZ stock to be above 85 at expiration in which case the bull Put spread will expire worthless as we wish.

In Example 2 we have a bear Call spread in addition to the bull Put credit spread described in Example 1.

What Your Mother Didn’t Tell You About Trading Iron Condors

The bear Call spread will prosper expire worthless so long as XYZ stock is below at expiration. Therefore, having both spreads does not increase the risk compared to having just one of the spreads, so only a single margin is required that covers both spreads at an options-friendly brokerage firm. Consequently, our profit potential is doubled as is our rate of return… again, with no increase in risk. There are literally thousands of potential credit spread candidates.

The investor, of course, needs to identify those spread contenders that offer the best mix of success probability, profit potential, and risk acceptability based on his personal profit objectives and risk tolerance, i.

Low Volatility SPY Iron CondorSee also white paper: Credit Spread Screening — How to Identify the Best Credit Spread s. In short, the investor should have an objective method that quantifies the criteria to be considered in selecting the best credit spreads for him to use. One of the most attractive investment vehicles for the conservative investor seeking recurring monthly income is the option credit spread and the related Iron Condor credit spread pair.

Objective criteria at least the nine discussed here! Investor can add criteria to those listed above, but at a minimum, specific values for all of the nine enumerated should be employed in the screening process. Provide your email contact information below your email privacy will be fully respected. We respect your email privacy. I trade vertical spreads regularly for the past few years now and have read many lessons about vertical spreads from many sources, books, etc.

I like the book so much as I can now trade vertical spreads with more confident and safe feeling. Lee Finberg Options Income Specialist — Small Risk. No one, however, can guarantee market profits. For a full description of the risks associated with such investments, see Disclaimers. Available both in physical book and e-book versions. Physical book version also a top seller at Amazon.

Simply CLICK HERE and get FREE instant access to Lee's This Pro's Options Income Technique report. Dorian Products, LLC - Sanford, FL The Monthly Income Machine, ISBN Tell a Friend. Click Here to get started with The Monthly Income Machine. The Basic Option Credit Spreads vs.

The Iron Condor trade might look like this: Result of making the single credit spread into an Iron Condor Recall in Example 1 that our desire is for the underlying XYZ stock to be above 85 at expiration in which case the bull Put spread will expire worthless as we wish. Iron Condor Screening Strategy for Best Credit Spread and Iron Condor Candidates There are literally thousands of potential credit spread candidates.

No earnings report if a stock-underlying spread prior to option expiration day Maximum Trading days until option expiration Minimum average daily trading volume of underlying stock, ETF, or Index Minimum distance of underlying stock, ETF, or Index from short strike price of credit spread Maximum delta value of short strike price option of credit spread Minimum net premium received when credit spread is established Maximum interval between long and short strike prices of credit spread Minimum open interest of option Predetermined Stop Loss point for exiting or adjusting a position if a major adverse move takes place Iron Condor Strategy — Summary and Conclusion One of the most attractive investment vehicles for the conservative investor seeking recurring monthly income is the option credit spread and the related Iron Condor credit spread pair.

Provide your email contact information below your email privacy will be fully respected af-form Credit Spread Screening — How to Identify the Best Credit Spreads. Popular Latest Comments Tags.

Adjusting Iron Condors

Option Stop Loss Orders? There Are Often Better Choices Adjust Credit Spreads — Sometimes Before Entering Them! Tesla may fit the criteria as long as option expir Dorian Products, LLC - Sanford, FL The Monthly Income Machine, ISBN