Factors affecting put option pricing

Kirk Du Plessis 3 Comments.

Investor Education - What Factors Affect the Prices of Options?

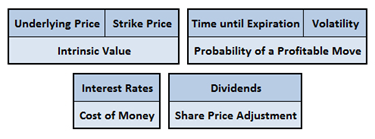

Understanding option pricing and value is critical to becoming a successful trader. Take gasoline prices for example. We all know that consumer demand, seasonal changes, crude oil prices, refinery productivity, state and local taxes, etc all affect the price you pay at the pump. When buying or selling options, there is a system used in the market by which the market gives a price for any option. This is the most commonly used model in the market today and the formula looks like this: As any other finance professional will tell you, calculating this by hand back at the universities is painful and tedious but does help you understand what can affect option pricing.

TR 97/20 - Income tax: arm's length transfer pricing methodologies for international dealings (As at 5 November )

Six out of the seven factors used in valuing options are known, and the last — Volatility — is supposed to be an estimate. Of course this presents a big problem.

Get the charts here. Start The FREE Course on "Options Basics" Today: Whether you are a completely new trader or an experienced trader, you'll still need to master the basics. The goal of this course is to help lay the groundwork for your education with some simple, yet important lessons surrounding options.

Click here to view all 20 lessons?

Current Stock Price — Think logically here. This works in the opposite for put options. Strike Price — This is the price at which a call owner may purchase stock, and the put owner may sell stock.

Of course you would always prefer the right to buy stock at a lower price any day of the week!

Thus, calls become more expensive as the strike price moves lower. Likewise, puts become more expensive in value as the strike price increases. Type of Option — The value of an option depends on which type it is: Clearly there would be a difference depending on which side of the trade and market you are on. This probably is the easiest variable to understand. Days Until Expiration — Options have a definitive life because of expiration.

Therefore, an option will increase in value with more time. Well, the more the time until expiration, the greater the probability or chance of a profitable move.

When interest rates are on the rise, the value of call options rise as well. If a trader decides to buy a call option instead of stock, then the extra cash they have should theoretically earn interest for them. Dividends — If a stock trades without giving the stockholder any dividend, it is said to be ex-dividend and its price goes down by the dividend amount. As dividend increases, puts are worth more while calls are worth less.

Volatility — The big variable right? In very simple terms, volatility measures the difference from day to day in a stocks price.

Does it move back and forth violently or trading in a defined range with little daily movement?

Factors affecting call and put option prices

Stocks that are volatile go through more frequent strike price levels than the non-volatile stocks. With these big moves, you have a higher chance of making money i. Thus an option on a volatile stock is much more expensive than one on a less volatile stock. Remember that even a small change in the volatility estimate can have a big impact on an options price. Kirk founded Option Alpha in early and currently serves as the Head Trader.

Kirk currently lives in Pennsylvania USA with his beautiful wife and two daughters. How Can A Call Option Decline In Value When A Stock Rises?

How Are Stock Market Option Trading Prices Determined? Stock Options And The 7 Factors That Determine Their Pricing And Value Kirk Du Plessis 3 Comments April 25, About The Author Kirk Du Plessis.

The Sax Angle Pingback: Free Video Training Courses. Real Money, LIVE Trades. Daily Options Trading Alerts.